Are You Doing Enough to Plan for Longevity?

Will you have enough money if you live to age 100 or beyond?

Longevity and mortality aren’t exactly fun things to even think about—much less talk about. But according to the U.S. Department of Health and Human Services, the percentage of people living past age 90 has grown dramatically over the past 40 years. And per Financial Advisor magazine, the number of Americans aged 100 or older has risen 44% since 2000.

Answering the question of how long you think you might live is important, because it impacts the following areas of retirement income planning (among others):

- When to start taking Social Security

- What might be a reasonable withdrawal rate from your portfolio

- Whether to take a lump sum pension option vs. annuity payments

- Whether to take single life or joint life pension payments

- Considering a lifetime income annuity to potentially provide additional guaranteed income from your portfolio

And the list goes on. All of the answers to these questions partially depend on your longevity assumption. And if you’ve got a spouse or significant other, you’ll have to make two assumptions.

Here’s part of the challenge with making longevity assumptions: studies have shown that most people are bad at it. When people are asked how long they think they’ll live, they typically underestimate actual longevity statistics. In fact, the Stanford Center on Longevity says that about 2/3 of pre-retiree men and 1/2 of pre-retiree women underestimated the average life expectancy of 65-year-olds.

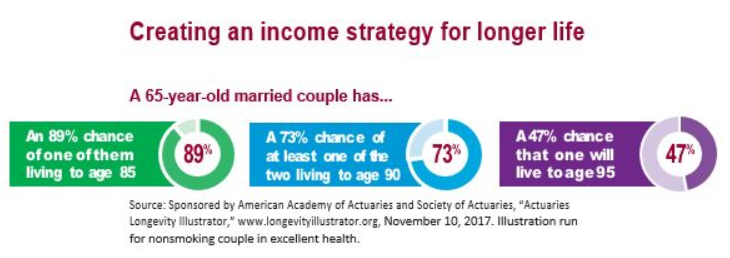

Here are the facts from the Society of Actuaries:

A 65-year-old couple has an 89% chance that at least one of them will live to age 85. They have a 73% chance that at least one of them will live to age 90. And they have a 47% chance that at least one of them will live to age 95.

So just think about that for a second relative to the longevity assumptions you may have made about yourself. Have you already put together a strategy with your financial advisor in case you or your spouse live that long?

People at all levels of wealth share a common fear that they won’t have money when they need it. They’re also afraid of having to rely on their kids to support them when they’re old. Our advice is to have a plan in place as early as possible to help take the worry out of outliving your savings. Once you’ve done that, feel free to live to 100!

If you need help planning for longevity, give us a call! We’re here to help.

Information presented should not be considered specific tax, legal, or investment advice. You should always seek counsel of the appropriate advisor prior to making any investment decision. All investments are subject to risk including the loss of principal. This material was gathered from sources believed to be reliable, however, its accuracy cannot be guaranteed.

Different types of investments and/or investment strategies involve varying levels of risk, and there can be no assurance that any specific investment or investment strategy (including the investments purchased and/or investment strategies devised by LCG) will be either suitable or profitable for a client's or prospective client's portfolio, thus, investments may result in a loss of principal. Accordingly, no client or prospective client should assume that the presentation (or any component thereof) serves as the receipt of, or a substitute for, personalized advice from LCG or from any other investment professional.

The information provided is based on current laws, which are subject to change at any time. Lucia Capital Group is not affiliated with or endorsed by the Social Security Administration or any government agency.

Social Security rules can be complex. For more information about Social Security benefits, visit the SSA website at www.ssa.gov, or call (800) 772-1213 to speak with an SSA representative.

Variable annuities are long-term investment products designed for retirement purposes. Variable annuities with guarantees are available through optional riders at additional cost. Guarantees are based on the claims-paying ability of the issuer subject to their terms and conditions. Early withdrawals may be subject to surrender penalties and, if taken prior to age 59½, may be subject to an additional 10% federal tax. Annuities are not FDIC insured. Certain terms and conditions apply, so please read insurance company materials carefully.

Investors are advised to carefully consider the investment objectives, risks, charges, and expenses of the variable annuity and its underlying investment options before investing. The applicable variable annuity prospectus contains this and other important information about the variable annuity and its underlying investment options. Please read the prospectus carefully before investing.

Rick Plum is a registered representative of, and offers securities through, Lucia Securities, LLC, a registered broker/dealer, member FINRA/SIPC. Advisory services offered through Lucia Capital Group, a registered investment advisor, and an affiliate of Lucia Securities, LLC. Registration with the SEC does not imply a certain level of skill or training.

Rick Plum is a registered representative of, and offers securities through, Lucia Securities, LLC, a registered broker/dealer, member FINRA/SIPC. Advisory services offered through Lucia Capital Group, a registered investment advisor, and an affiliate of Lucia Securities, LLC. Registration with the SEC does not imply a certain level of skill or training.