How to Take Advantage of Your Zero-Percent Tax Bracket

Introduction

We talk a lot about tax management, and for good reason. Knowing how various kinds of income are taxed may allow you to minimize your tax bill by taking advantage of what the tax brackets and tax laws give us.

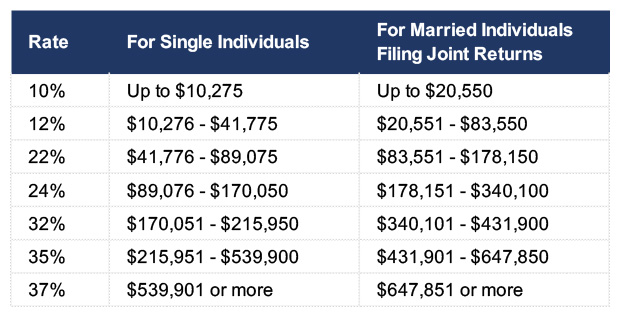

For example, did you know that the first $26,000 or so of income for a married couple filing jointly is not taxed at all? That’s right – that first chunk of income is technically in a zero-percent bracket! But you wouldn’t know that if you just looked online at the tax brackets and rates for 2022. A quick search might give you a table that looks like this:

2022 Federal Income Tax Brackets and Rates for Single Filers, Married Couples Filing Jointly, and Heads of Households

Source: Internal Revenue Service

You’ll see a 10% bracket along with the amount of income that’s taxed at that rate, then a 12% bracket, a 22, and so on, all the way up to 37% for those whose “taxable” income is above five or six hundred thousand dollars, depending on whether they’re filing single or joint married.

So what this means is that the first 20 grand or so of “taxable” income for a joint return is taxed at a 10% rate, then the next chunk, the next $63,000 of income, is taxed at 12%, and it continues on up. Once your taxable income is calculated, a tax rate is applied to each of those dollars.

Now remember, “taxable” income is less than your total gross income, because not all of your income is taxed.

Look at it this way: You have your gross income, which includes your wages, dividends, capital gains, business income, retirement distributions, and so forth. Then you have your adjusted gross income, which subtracts things like student loan interest and your retirement account contributions. Then you have your taxable income below that. But right in between the adjusted gross income and the taxable income, you’ll have one of two things — either a standard deduction, or a list of your itemized deductions. And you get to reduce your adjusted gross income by that standard or itemized amount, whichever is higher.

In other words, that chunk of income – the standard deduction or your itemized deductions – is yours to keep, tax free. For married couples, the standard deduction is just shy of $26,000 this year. So, technically speaking, although it doesn’t exist officially, that $26,000 of income falls in a zero-percent tax bracket.

Okay, I’m throwing lots of numbers at you – it can get confusing. Here’s an example of how it works.

Here’s an example

We’ll take a hypothetical married couple with $100,000 of gross income. We’ll keep it simple – they have no 401k, no other deductions anywhere, it’s just $100,000 of adjusted gross income for the year. They want to know how much that $100K of income will be taxed, so they went online, found the tax table that I showed you earlier, and ran the calculations – 10% on the first approximately 20 grand, 12% on the next 63 grand, and 22% on the last 17 grand or so. Add it all up, and they figured that their tax bill on their $100,000 of income would be just shy of $13,200 – a 13.2% overall or average rate.

But their calculations in this case would be wrong. Why? Because our hypothetical couple forgot about the nearly $26,000 standard deduction they get this year which of course is not taxed at all – a zero percent rate. They should have done their tax calculations on $74,000 of “taxable” income – the 100 grand minus the 26,000-dollar standard deduction. By the way, if you’re 65 or older, your standard deduction is even larger.

When you run those numbers, their tax bill is considerably lower: roughly $8,500 – NOT 13-two. This is because with $74,000 of taxable income, none of it falls in the 22% bracket, and there’s even a little bit of room left in the 12!

And by the way, here’s some quick tax management advice for you. If you’ve got some room left in the 12% bracket, you may want to consider converting some money from your 401k or traditional, taxable IRA to a Roth IRA. Sure, you’ll pay taxes on it, but you’ll have to pay taxes on it eventually anyway, and unless you think tax rates will be lower in the future, that 12% rate might look pretty good. Your advisor can help you go over your options.

Bringing it all together

The point is that if you’ve got an opportunity to use the tax brackets to your advantage, you should do so. If you’ve got a chance to take taxable money tax-free, don’t pass that up. Or if you’re in a window of time where you can pay lower taxes now than you will in the future, don’t let that go to waste.

And by the way, I haven’t even mentioned what happens when you add in the complications of the taxability of Social Security! Just another reason why you need to talk with us and get your strategy all set.

Tax management is something we do every single day for our clients here at Lucia Capital Group. It’s all part of the planning process. If you want to know more about how a tax-management strategy may benefit you, just give us a call. As always, we’re here to help!

Important Information:

The information provided should not be considered specific tax, legal, or investment advice and is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

Different types of investments and/or investment strategies involve varying levels of risk, and there can be no assurance that any specific investment or investment strategy will be profitable for a client's or prospective client's portfolio, thus, investments may result in a loss of principal. Accordingly, no client or prospective client should assume that the information presented serves as the receipt of, or a substitute for, personalized advice from Lucia Capital Group or from any other investment professional.

You should always seek counsel of the appropriate advisor prior to making any investment decision. All investments are subject to risk including the loss of principal. This material was gathered from sources believed to be reliable, however, its accuracy cannot be guaranteed.

Examples cited are hypothetical, are for illustrative purposes only, are not guaranteed and subject to potential federal and state law amendments. There is no guarantee that you will achieve the results discussed or illustrated.

IRA withdrawals will be taxed at ordinary income rates. Withdrawals prior to age 59½ may also be subject to a 10% penalty tax.

Roth IRA distributions of principal from a Roth IRA are tax-free; however, any earnings will be taxed at ordinary income rates and a 10% penalty tax will apply if withdrawn prior to age 59½ or within five years of the date the Roth IRA was established, whichever is longer.

Rick Plum is a registered representative with, and securities and advisory services offered through LPL Financial, a registered investment advisor and member FINRA/SIPC. The investment professionals are affiliated with LPL Financial and are conducting business using the name Lucia Capital Group, a separate entity from LPL Financial.