This Is Why We Strategize!

A few weeks ago, as market volatility related to the corona virus was picking up, we told you that short-term volatility was likely to continue — and it has. With a little over 20% drop in most major market indices, we’re now officially in a bear market.

A key point in our prior video was a reminder that the Buckets Strategy anticipates that we will have bear markets and is designed to prepare for those in advance. So if you’re following and reviewing your Buckets Strategy on a periodic basis, then there should be no reason to let what is likely short-term volatility change your long-term strategy.

Today, I want to review why we anticipate these market drops when we help you design your Bucket Strategy.

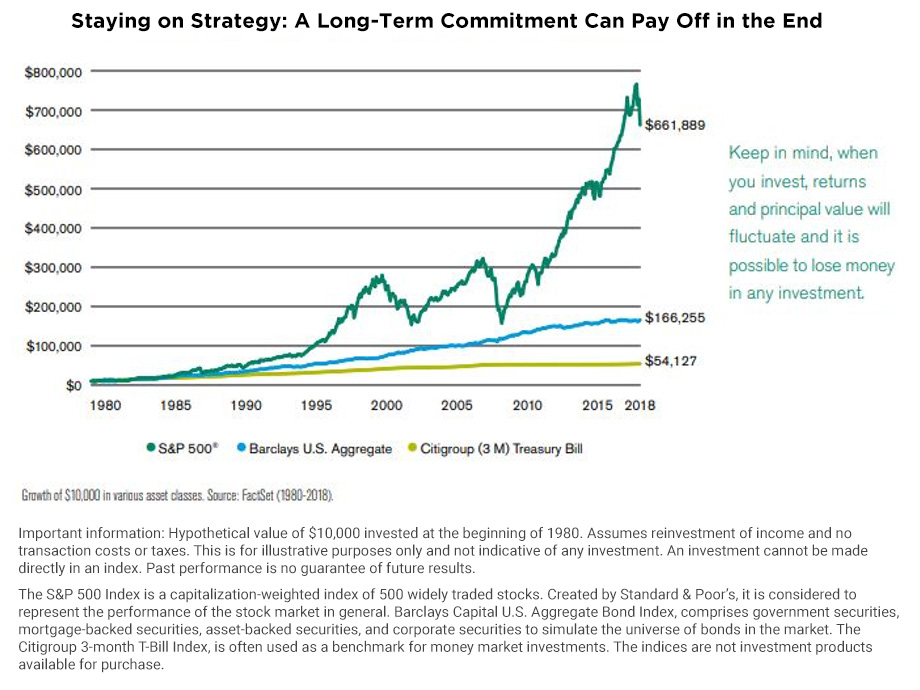

Let’s start with why we invest in stocks in the first place. Over the long-term, stocks are typically one of the best performing asset classes.

If you’d invested $10,000 in the S&P 500 and reinvested the dividends, in this hypothetical example, at the end of 2018 it would’ve grown to well over $600,000. Of course, that’s looking at it over a nearly 40-year time period. That’s a long-term proposition.

The biggest problem with stocks, though, is that in the short-term, they can be really, really volatile.

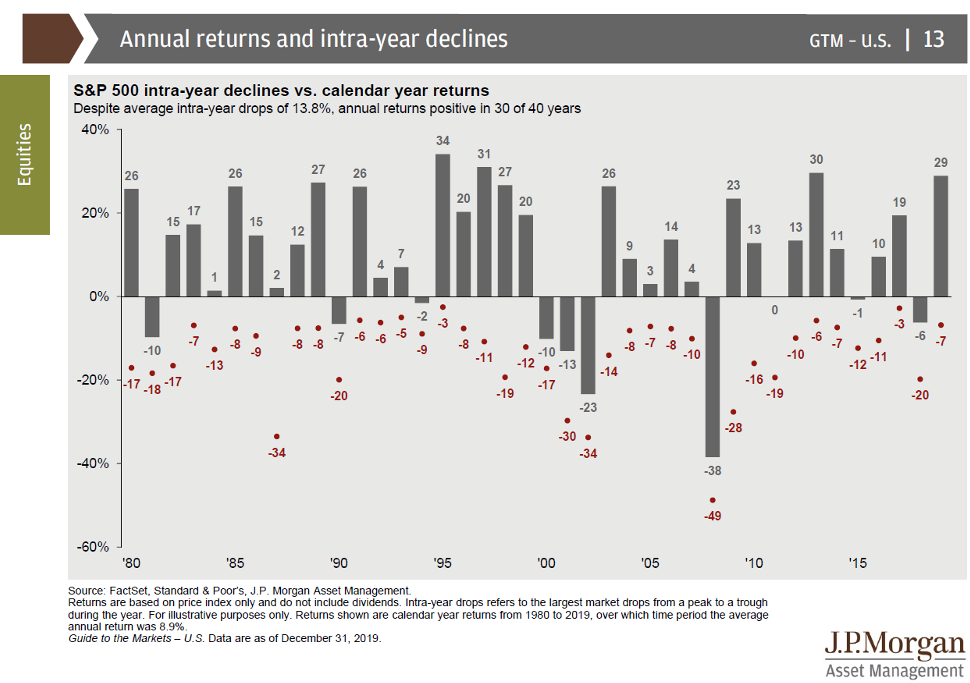

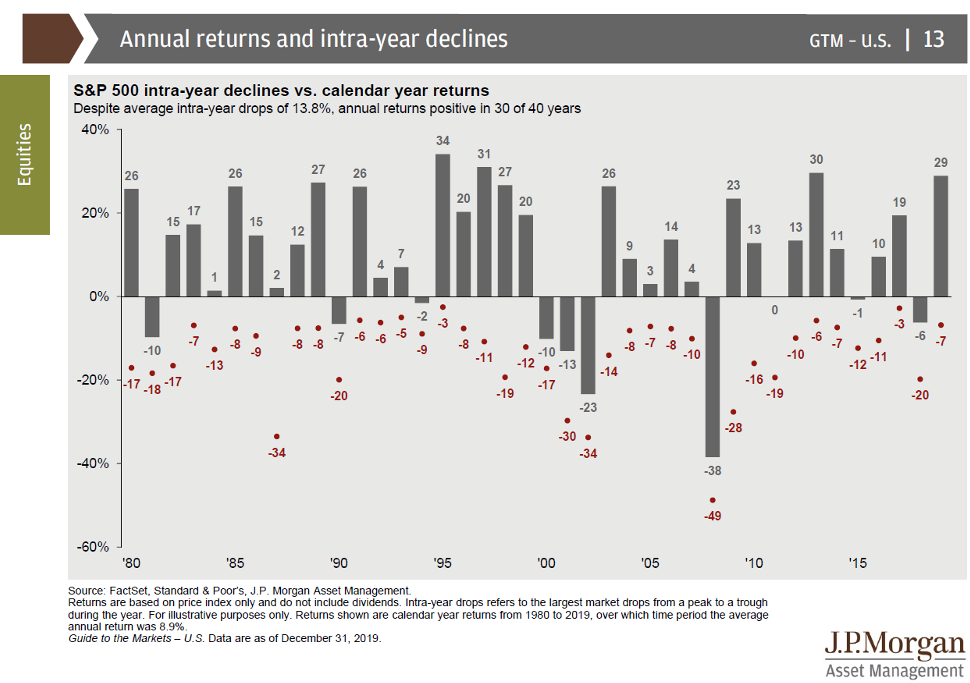

What this chart demonstrates is that it’s not uncommon for the market to drop during the year, sometimes significantly so. You may also want to take note of the fact that in many of the calendar years when there has been a drop, the market finished that year with positive returns.

Sometimes market corrections, like the one we’re seeing right now, are significant enough to be called bear markets, and it can take a number of months or even years to recover from those drops. And while past performance is absolutely no guarantee of future results, historically the markets (using the S&P 500 as a proxy) have recovered over time.

So TIME is a key to getting the potential long-term benefits of stocks while surviving the short-term volatility. We’ve seen other world epidemics in the past, like SARS, Cholera, Zika virus, Ebola – and the markets have always come back afterwards.

Of course, the severity of this virus will ultimately dictate how the markets react, and just because the indexes have shrugged these off in the past doesn’t mean that will be the case this time.

But no matter what happens, we’ve taken things like this into account when we helped you develop your buckets plan. If you’ve been following and reviewing your strategy, you may find this to be a great opportunity to take advantage of things like Roth conversions, tax loss harvesting, in-kind distributions of your RMD, or even simply increasing your IRA contributions.

We believe the best course of action is to act rationally during irrational times, and stick with a strategy. Staying invested when others are selling may help to keep your portfolio on track to meet your long-term goals.

And remember – if you’re concerned, worried, or have any questions about what’s been going on over the past week or two, just give us a call, talk with your advisor, and we’ll help you out. It’s why we’re here.

Important Information:

The information provided should not be considered specific tax, legal, or investment advice and is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. This material was gathered from sources believed to be reliable, however, its accuracy cannot be guaranteed.

Different types of investments and/or investment strategies involve varying levels of risk, and there can be no assurance that any specific investment or investment strategy (including the investments purchased and/or investment strategies devised by Lucia Capital Group (“LCG”)) will be either suitable or profitable for a client's or prospective client's portfolio, thus, investments may result in a loss of principal. Accordingly, no client or prospective client should assume that the presentation (or any component thereof) serves as the receipt of, or a substitute for, personalized advice from LCG or from any other investment professional. You should always seek counsel of the appropriate advisor prior to making any investment decision.

Examples cited are hypothetical, are for illustrative purposes only, are not guaranteed and subject to potential federal and state law amendments. There is no guarantee that you will achieve the results discussed or illustrated.

It is important to keep in mind that investments in fixed income products are subject to liquidity (or market) risk, interest rate risk (bonds ordinarily decline in price when interest rates rise and rise in price when interest rates fall), financial (or credit) risk, inflation (or purchasing power) risk and special tax liabilities. Interest may be subject to the alternative minimum tax. Treasury securities are backed by full faith and credit of the U. S. Government but are subject to inflation risk.

Money market mutual funds, though traditionally lacking federal insurance and not without risk, are highly regulated under federal law.

Before investing, carefully consider a mutual fund’s investment objectives, risks, charges, and expenses. To obtain a prospectus or summary prospectus, which contains this and other information, call your financial advisor. Read the prospectus carefully before investing.

Raymond J. Lucia Jr. is chairman of Lucia Capital Group (LCG), a registered investment advisor and CEO of its affiliated broker-dealer, Lucia Securities, LLC (LSL), member FINRA/SIPC. Registration with the SEC does not imply a certain level of skill or training.