The Bucket Strategy®

Helping you manage your income in retirement

Segmenting Your Assets

A liability-driven approach to investing for retirement income

The Bucket Strategy® generally consists of three buckets, across five bucket categories, ranging from conservative to aggressive. It serves as a framework to help you make decisions regarding the unique challenges of the withdrawal, or decumulation, phase of retirement. The Bucket Strategy® then helps you to match your assets to your liabilities (or income needs) in retirement, aiming to give a purpose to every dollar in your portfolio and operating similarly to how endowments and pension plans manage their portfolios.

You’ve got financial liabilities—we all do. Some, like your mortgage, your day-to-day living expenses, and other recurring bills, need to be taken care of immediately. These are short-term liabilities. Others are more long-term in nature: a young child’s college education, a legacy for your heirs, or even the daily living expenses you’ll need twenty years from now.

How should these liabilities be funded? And where does the money to fund these liabilities come from? The Bucket Strategy® aims to address these questions with its liability-driven approach.

In its most basic form, The Bucket Strategy® divides your portfolio’s assets into different segments—called buckets—each with its own time horizon, risk tolerance, and investment objective.

If you have bills that must be paid in the short term, that money should come from a source that is independent from, and less affected by, volatile movements in the stock market. The rate of return is typically low, but the money potentially has a better chance of being there when you need it.

Other liabilities, such as those that you won’t need to fund for several years, can be funded with longer-term assets that can withstand a little more risk (thus allowing you a potentially better rate of return).

As your short-term bucket depletes, it is designed to periodically be refilled by one of the longer-term buckets—and this process is designed to repeat itself.

The whole idea is to match your assets with your liabilities so that you’re not forced to rely on riskier, longer-term assets to fund your spending needs today.

We can’t control the movements of the stock market, and we don’t want market movements to control how much money you have available to spend. By keeping your short-term liabilities financed with short-term assets, The Bucket Strategy® aims to deliver predictable withdrawals from your portfolio to help you work towards your retirement income needs.

Understanding the Strategy

Your Bucket Strategy is unique to your personal situation

Your personalized Bucket Strategy is generated based on a financial questionnaire completed by you, the client, and is specific to your personal situation. The financial profile information from this questionnaire is used to design your portfolio based on retirement and bucket assumptions. Retirement assumptions include determining whether to design the portfolio based on withdrawal rate (a percentage of the portfolio value at retirement) or based on total potential income from all sources as well as taking into account a portfolio withdrawal strategy designed to pursue your total income needs (including portfolio withdrawals and other income, such as retirement income, pensions, and rental income).

This bucket category provides investors with guaranteed income for life and is generally suitable for conservative investors who believe they have a long life expectancy. Potential investment solutions are life annuities and variable annuities with guaranteed withdrawal/income benefit features.

The Fixed Income bucket is designed to spend down over five to seven years, thus “buying time” for the Balanced bucket to potentially grow. This category is typically invested in non-volatile (sometimes guaranteed) investments, including money markets, CDs, short-term debt securities, and fixed annuities.

The Balanced bucket is the bridge between your Fixed Income and Long-Term Growth buckets. This bucket is designed to replenish the Fixed Income bucket, resulting in additional time for your long-term investments to potentially grow. Suitable investment options include laddered bonds, balanced portfolios, fixed and indexed annuities, structured products, UITs, and closed-end funds.

The Long-Term Growth bucket is designed for 15 to 25 years of growth. As your other buckets are designed to buy you time, this bucket is designed to grow untouched for near-term income. Therefore, we generally allocate this category to equities such as domestic and international stocks, commodities, currencies, and alternative investments.

The Alternatives bucket is designed to provide both growth and income for the portfolio over the long term. Income generated from this bucket may be used to supplement income required from the Fixed Income bucket. Dividend-paying investments (such as non-traded REITs and other high-yield investments) are appropriate for this category.

Reporting and Progress

The Bucket Strategy® Wealth Analysis

The Bucket Strategy® Wealth Analysis is our comprehensive report that provides you with a look at where you stand currently and where a financial plan may lead you.

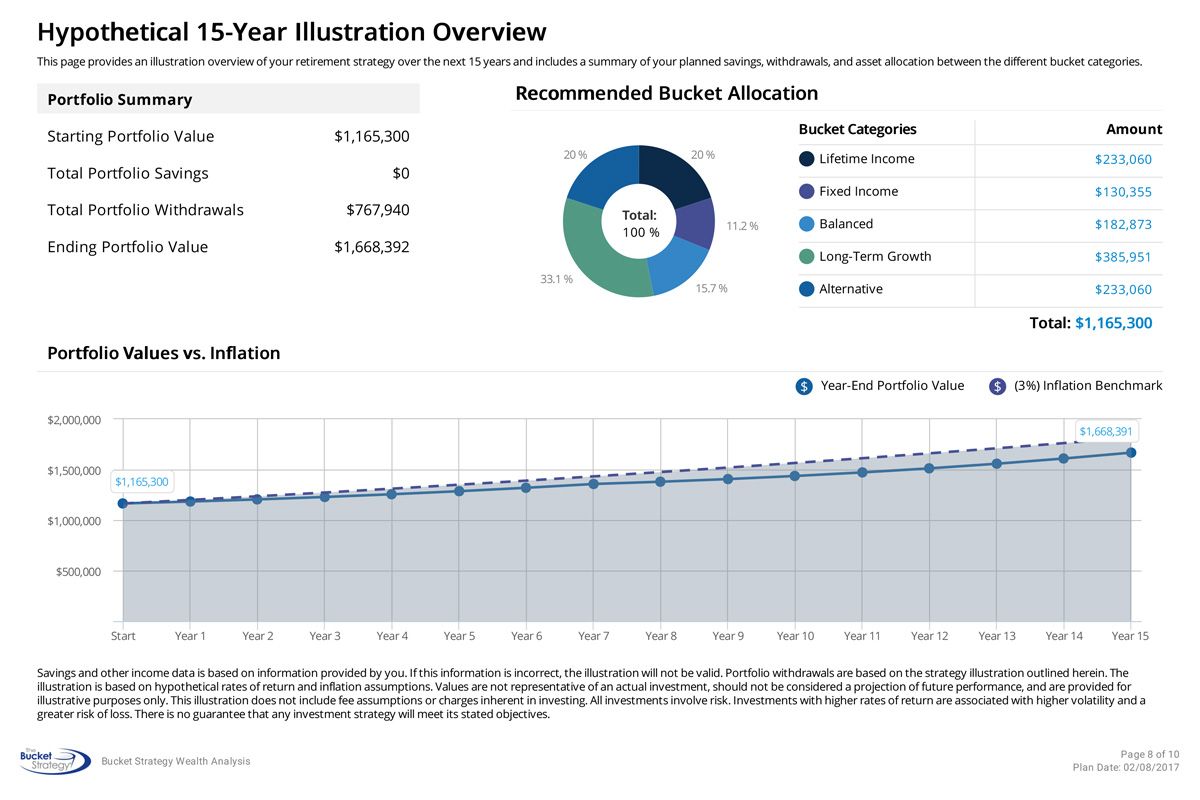

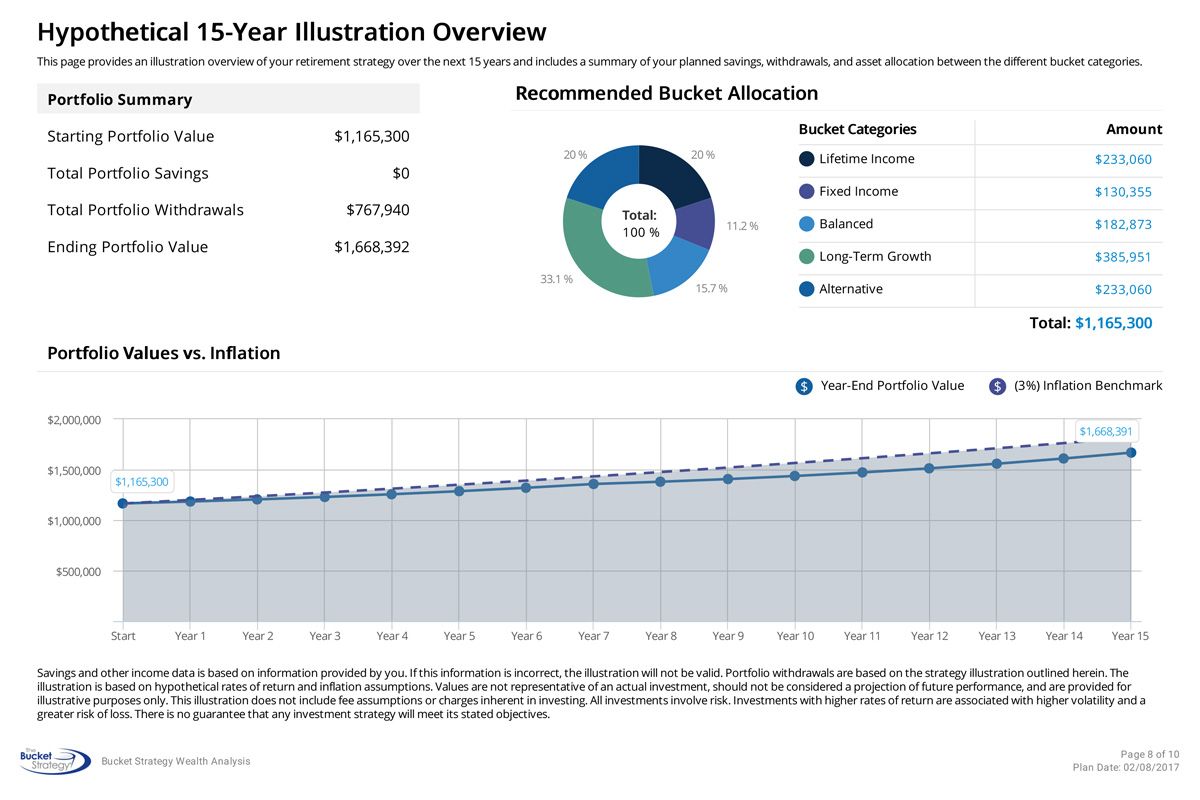

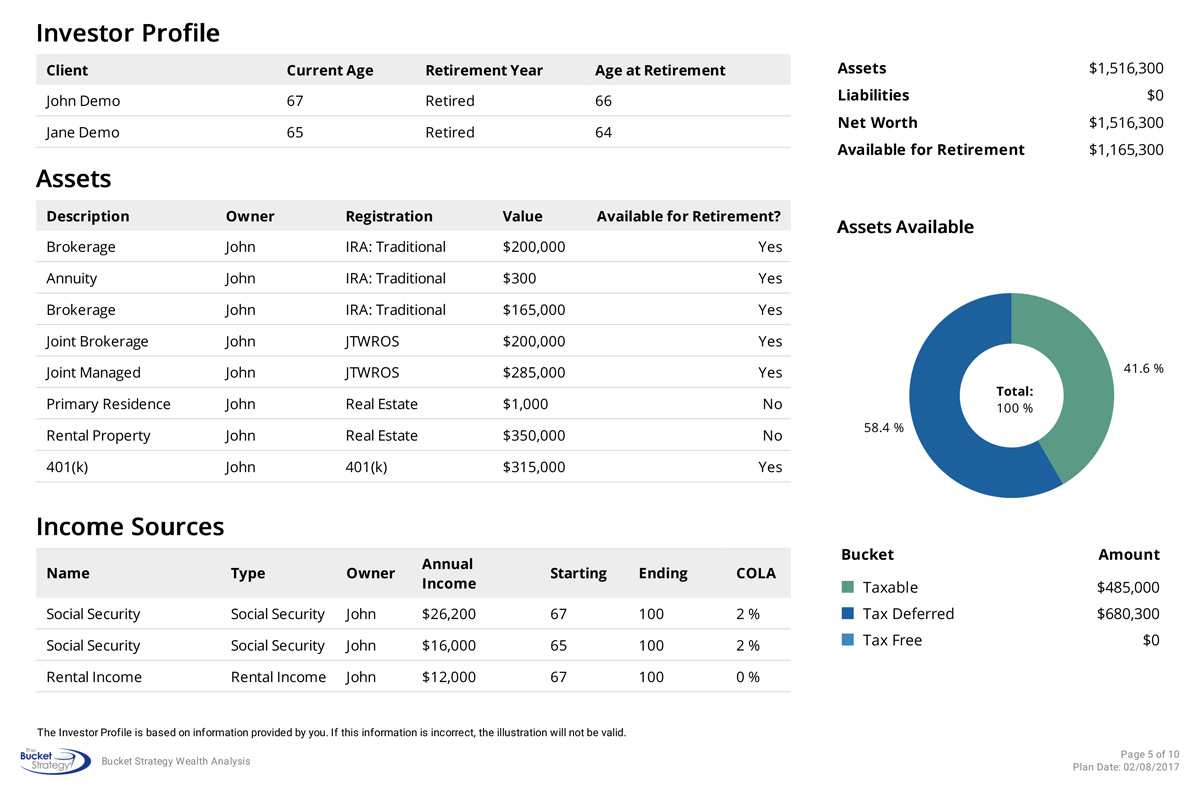

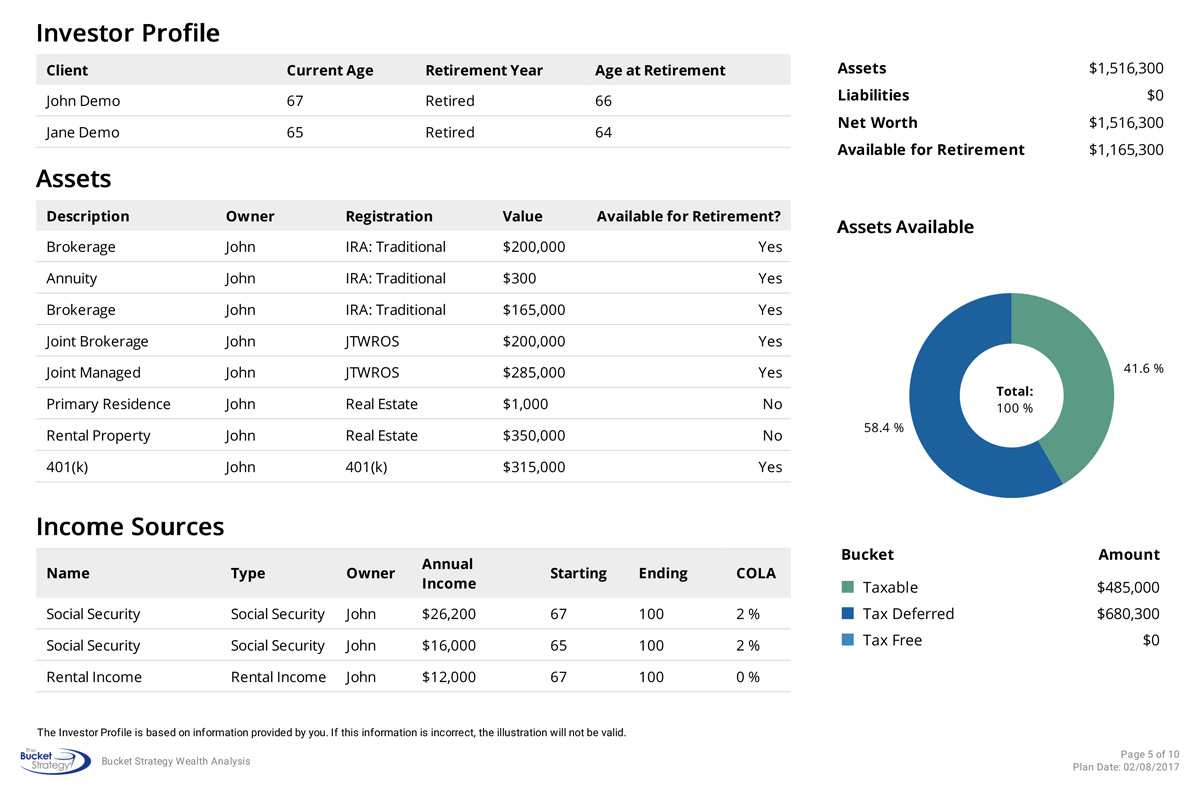

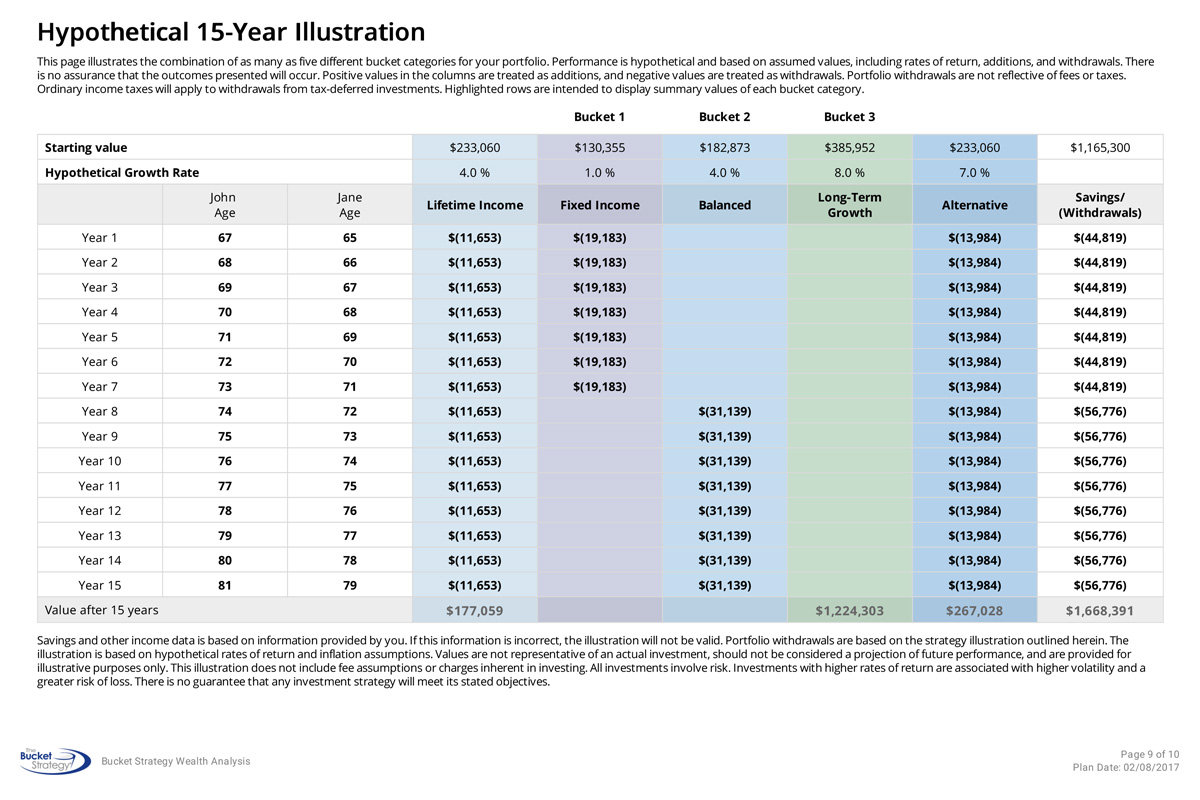

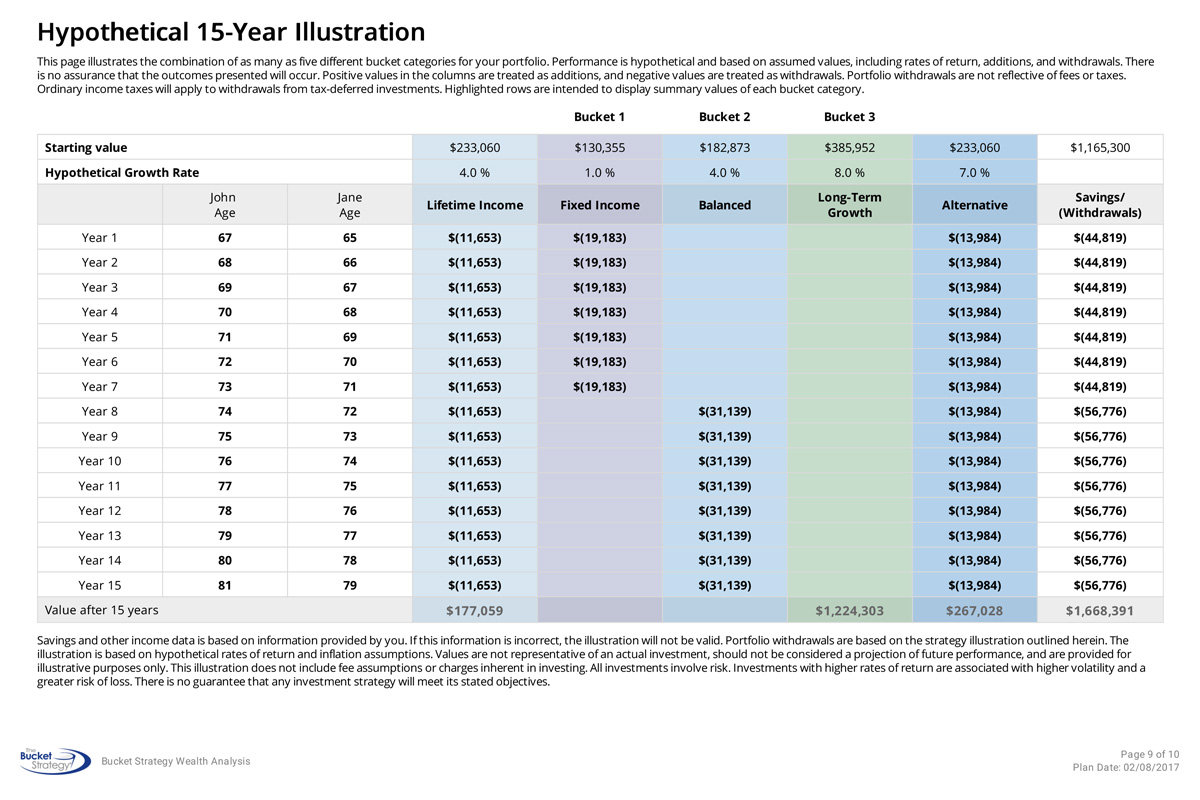

As you begin the planning process, it’s helpful to have a snapshot of where you are today. The Bucket Strategy® Wealth Analysis starts with your current assets then provides you with a hypothetical cash flow projection over the following 15 years within the framework of a Bucket Strategy plan.

In conjunction with the cash flow projection, the analysis also includes a proposed account allocation to the various bucket categories that shows you where specific dollar amounts are allocated among the Lifetime Income, Fixed Income, Balanced, Long-Term Growth, and Alternatives buckets, where appropriate.

Tracking Progress

The Bucket Strategy® Progress Report

You’ll recall from your school days how a midterm report would allow you to see how you were doing and which areas (if any) needed extra attention.

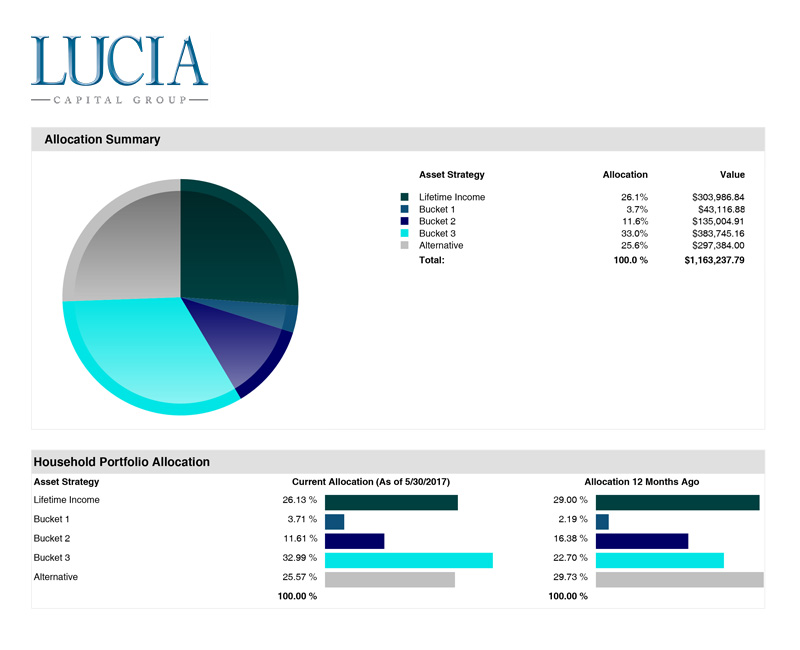

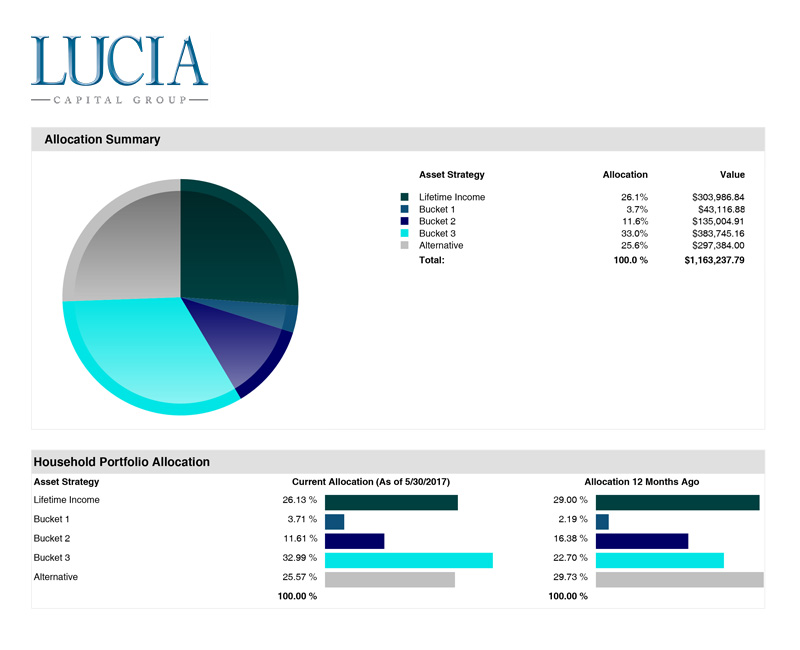

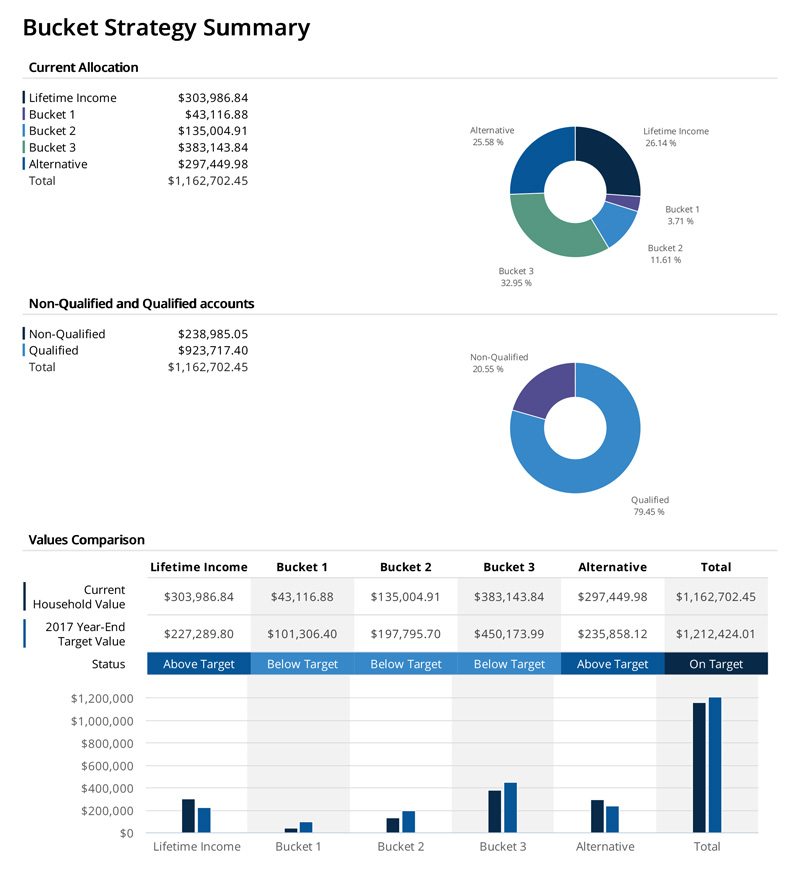

Our Bucket Strategy Progress Report provides periodic updates to you so that you’re able to see at a glance how your accounts are doing. We include summaries of your Bucket Strategy plan and household accounts, along with a comparison of account values across each allocation in the individual buckets. This report will analyze where you might be above, below, or right on the targets that were set up during your initial strategy session.

The purpose here is to find out where adjustments might need to be made and to keep you on track so that you never lose sight of your goals.

Bringing It Together

A consolidated position report

Your consolidated position report will provide you with a current household allocation summary and, for comparison, a summary of your allocation 12 months prior. In this report you’ll also see consolidated portfolio detail, where you’ll find the asset class, units, price, value, and portfolio composition information for each bucket.