Lucia Capital Group Announces New Investment Advice Subscription Service

New Service, ClickGoals, Expected to Launch Fall 2018

National wealth management firm Lucia Capital Group today announced its forthcoming subscription service, ClickGoals, which will offer financial planning advice and investment management services at a range of prices reflecting investors’ service requirements.

In an effort to better serve an ever-widening range of client needs, the new ClickGoals subscription service will target investors with simple portfolios as well as those just starting out.

“The goal is to match the value of services provided with the end cost to the client,” said Ray Lucia Jr., chairman and CEO of Lucia Capital Group. “We look at our services as a combination of financial planning and investment management. Some clients need a lot of financial planning advice and are less focused on investment management services, while others focus more heavily on investment management services and have little need for financial planning advice. That’s why we’ve created a way for our firm to service a wide range of investors’ needs that’s independent of how much those clients choose to invest with us. With the rollout of ClickGoals.com, you can be our client for a low monthly subscription fee and expand your relationship over time into our other programs where we offer more advice and investment management services. It’s our way of showing we are here to help in whatever capacity is best for you.”

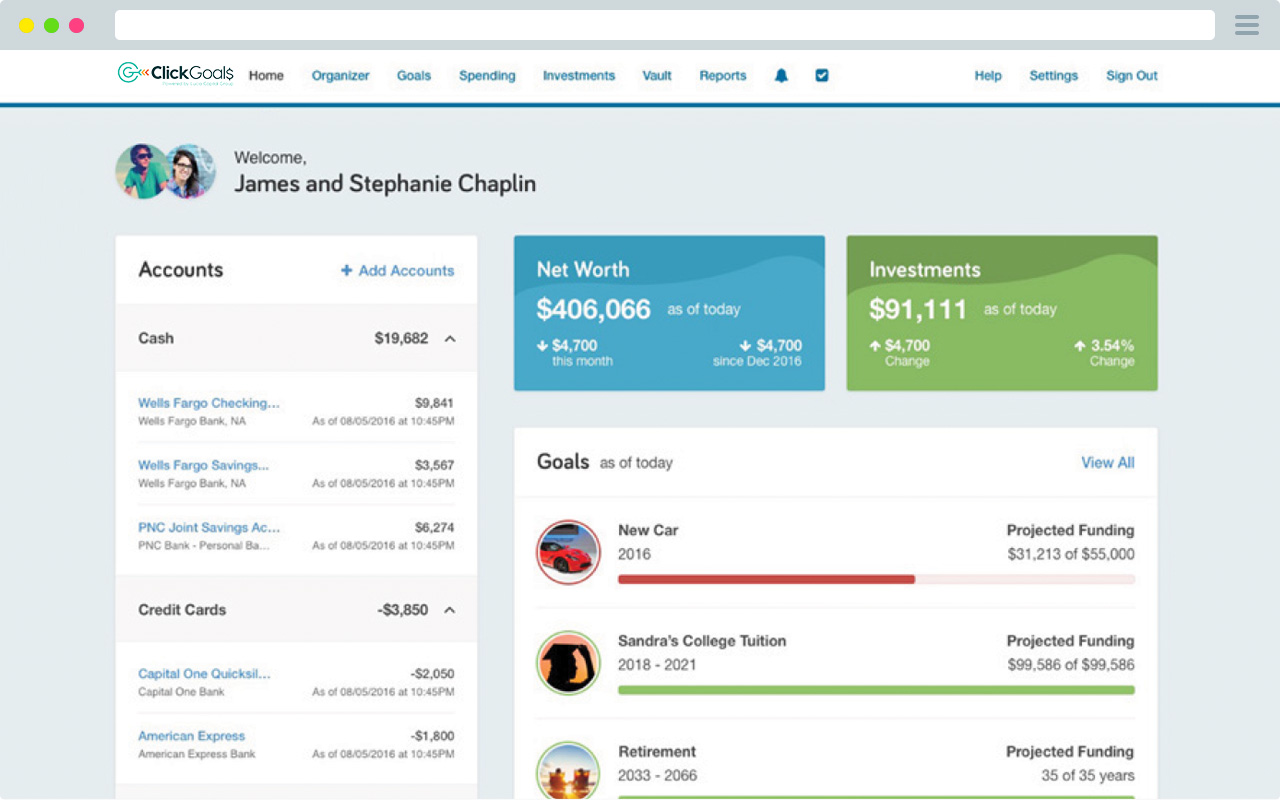

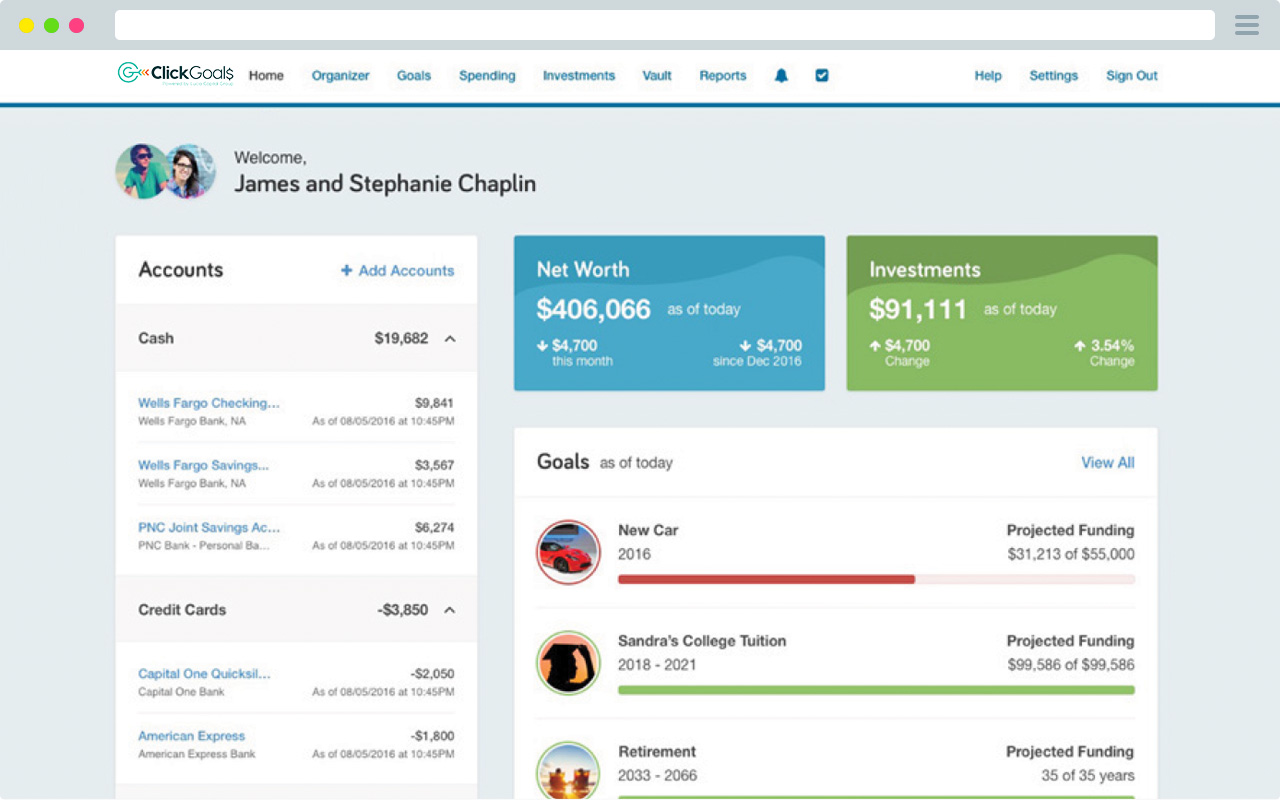

ClickGoals, expected to start as low as $50 per month, will be a powerful tool for investors not needing considerable financial advice. ClickGoals subscribers will be given access to a Personal Financial Dashboard where they can securely view all of their accounts in one place (such as bank accounts, credit card balances, and investment accounts). Subscribers will also gain access to budgeting and goal planning tools on a self-directed basis. In addition to receiving complimentary coaching services related to managing their Personal Financial Dashboard, for a fee subscribers will also be able to work with CERTIFIED FINANCIAL PLANNER™ professionals for project-based services, such as asset allocation and portfolio risk management, education funding, life insurance gap analysis, retirement probability (using a Monte Carlo simulation), and other what-if scenarios. Project-based services are expected to be priced at a modest $97 per engagement. Lastly, subscribers will also receive access to globally diversified portfolios providing market access at internal expenses that are a fraction of the standard cost. Investment management services for these accounts is included in the monthly subscription fee.

“As we strive to constantly exceed the expectations of our clients, we are extremely proud of this lineup of services designed with our clients in mind,” said Joe P. Lucia, president of Lucia Capital Group. “By leveraging our technology behind the scenes, we aim to provide seamless, hassle-free transitions between services as clients’ needs evolve over time.”

Lucia Capital Group employs a wealth of technology in order to make its ClickGoals subscription service flourish. In addition to contracting eMoney and Riskalyze as the firm’s primary technology providers, Lucia Capital Group also utilizes Schwab Institutional Intelligent Portfolios for its digital investing platform, Salesforce for CRM, Orion Advisor Services for trading and portfolio management, and its own proprietary Bucket Strategy Illustration Software for retirement planning services.

Currently, Lucia Capital Group offers two levels of service to its clientele: the Lucia Wealth Program and the Private Client Program.

The Lucia Wealth Program is for investors nearing or living out their retirement. In addition to receiving all benefits that will be offered by the ClickGoals program in the fall, Lucia Wealth Program investors work with a dedicated financial advisor and enjoy access to a wide range of investment management services (including mutual fund and ETF model portfolios; individual stock portfolios; advisor-directed services, including management of legacy positions; and other personalized investment management, including alternative investments and annuities).

The Private Client Program provides advice and financial coaching for high-net-worth investors. Advisors servicing this client group focus on providing a completely personalized investment program, covering individual equity and fixed-income investments, as well as individualized tax management for specific securities.

ClickGoals is expected to launch in fall 2018. For more information, visit ClickGoals.com.

Information presented should not be considered specific tax, legal, or investment advice. You should always seek counsel of the appropriate advisor prior to making any investment decision. All investments are subject to risk including the loss of principal. This material was gathered from sources believed to be reliable; however, its accuracy cannot be guaranteed.

Different types of investments and/or investment strategies involve varying levels of risk, and there can be no assurance that any specific investment or investment strategy (including the investments purchased and/or investment strategies devised by LCG) will be either suitable or profitable for a client’s or prospective client’s portfolio, thus, investments may result in a loss of principal. Accordingly, no client or prospective client should assume that the presentation (or any component thereof) serves as the receipt of, or a substitute for, personalized advice from LCG or from any other investment professional.

The Bucket Strategy® involves investments subject to risks, fees, and expenses. There is no guarantee that any investing strategy will be profitable or provide protection from loss.

Raymond J. Lucia Jr. and Joseph P. Lucia are registered representatives of, and offer securities through, Lucia Securities, LLC, a registered broker dealer, member FINRA/SIPC. Advisory services offered through Lucia Capital Group, a registered investment advisor and an affiliate of Lucia Securities, LLC. Registered representatives of Lucia Capital Group only conduct business in the states where they are currently licensed. Registration with the SEC does not imply a certain level of skill or training.

eMoney, Riskalyze, Schwab Institutional Intelligent Portfolios, Salesforce, and Orion Advisory Services are not affiliates of Lucia Capital Group or any of its subsidiaries.