Can You Reduce Your Risk Without Sacrificing Your Return?

When we meet with someone for the first time, we often find that they’re taking far more risk than they should, given their stated objectives. They understandably like the greater potential for return, but in order to get that return, they figure they’ve got to raise the risk. And yes: risk and return do generally go hand in hand.

But what you might not know is that by making just a few adjustments to your portfolio, you may be able to reduce the risk side without giving up a substantial portion of the return side.

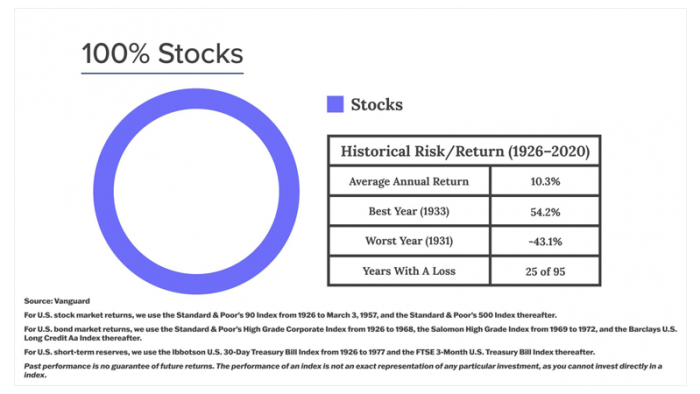

100% Stocks

Let’s take a look at an allocation of 100 % stocks.

It’s not surprising that over a 95-year period, we saw an average annual return of 10.3%, and positive rates of return in about 3 of every 4 years. But a 100% stock portfolio also carries the most volatility and risk: it lost 43% at its worst, and then was up 54% just two years later. And even then, it was still down 12% from where it was before the drop. That’s a roller coaster ride! And it could make you more than a little nervous.

But a 100% allocation to stocks is a bit unusual for a retiree. In reality, most people, especially those who are retired, don’t have an overall portfolio asset allocation that is 100% stock. In a typical retiree asset allocation, fixed income assets, such as bonds, are used to “buffer” stock market volatility, which tends to give it more “balance.”

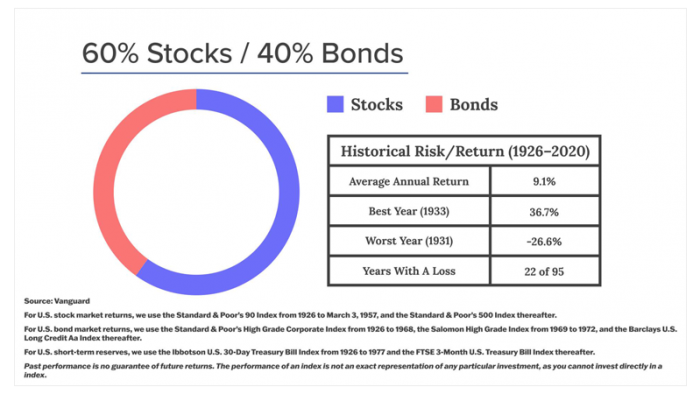

60% Stocks / 40% Bonds

So what happens to our rate of return if we reduce stocks from 100% down to 60%, with 40% bonds?

The volatility goes down substantially, but the average historical annual return is only lessened by about 1 percent, from 10.3 to 9.1%

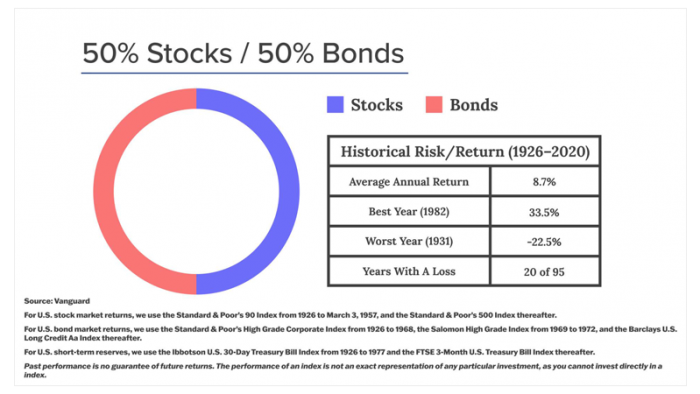

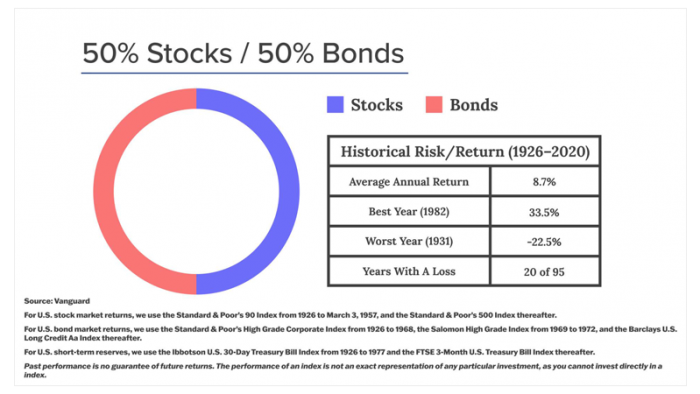

50% Stocks / 50% Bonds

Now what if we reduce it further, to a 50/50 stock/bond mix?

Once again, we see reduced volatility, but our historical average annual rate of return dips only slightly, from just over 9%, down to 8.7%.

Summary

Let’s ask you this: would you be willing to trade a lot of volatility and risk in exchange for about a 1 to 2-percent reduction in your potential return? Could you achieve your retirement goals with maybe an 8-plus percent average annual rate of return instead of, say, 10%? We like that deal.

Let’s be clear: these numbers we are giving you are over a very long time period, and there’s no guarantee that stocks will achieve these exact same results going forward, especially if your own time horizon is substantially shorter. And given today’s low interest rate environment, those bond returns will be lower than the historical average.

But we think we’ve illustrated an important point: by making some small but significant changes to your portfolio’s asset allocation, you may be able to reduce your risk and volatility substantially without having to give up a large amount of return.

At Lucia Capital Group, we try to keep the focus on you and your goals. Our bucket strategy framework aims to help you customize your asset allocation to whatever those specific goals are. Simply put: we want you to be able to sleep at night. How can we help you the most? Just give us a call: we’re always here for you.

Important Information:

The information provided should not be considered specific tax, legal, or investment advice and is not specific to any individual’s personal circumstances. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

You should always seek counsel of the appropriate advisor prior to making any investment decision. All investments are subject to risk including the loss of principal. This material was gathered from sources believed to be reliable, however, its accuracy cannot be guaranteed.

Different types of investments and/or investment strategies involve varying levels of risk, and there can be no assurance that any specific investment or investment strategy (including the investments purchased and/or investment strategies devised by Lucia Capital Group (“LCG”)) will be either suitable or profitable for a client's or prospective client's portfolio, thus, investments may result in a loss of principal. Accordingly, no client or prospective client should assume that the presentation (or any component thereof) serves as the receipt of, or a substitute for, personalized advice from LCG or from any other investment professional.

S&P 500 Index is an unmanaged index and includes a representative sample of large-cap U.S. companies in leading industries. An investment may not be made directly in an index.

It is important to keep in mind that investments in fixed income products are subject to liquidity (or market) risk, interest rate risk (bonds ordinarily decline in price when interest rates rise and rise in price when interest rates fall), financial (or credit) risk, inflation (or purchasing power) risk and special tax liabilities. Interest may be subject to the alternative minimum tax. Treasury securities are backed by full faith and credit of the U. S. Government but are subject to inflation risk.

Rick Plum is a registered representative with, and securities and advisory services offered through LPL Financial, a registered investment advisor and member FINRA/SIPC. The investment professionals are affiliated with LPL Financial and are conducting business using the name Lucia Capital Group, a separate entity from LPL Financial.