Why You Should Manage Risk In Your Portfolio

We don’t think it’s a stretch to say that many investors are obsessed with outperforming the market. This, we believe, is a huge mistake. When you manage exclusively for returns, you tend to forget about risk; and risk is really the most important part of the equation.

This is why it’s far better to manage the risk in your portfolio, because when it comes to investing, returns are not always what you want them to be when you need them. Risk, though, is pretty much guaranteed.

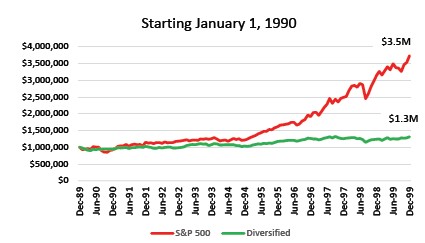

Let’s illustrate this with a hypothetical situation: two individuals retire on January 1, 1990. Both of them have $1 million, and both want to take $45,000 of annual income with an adjustment each year for inflation. One investor diversifies with an equal mix of US stocks and bonds, international stocks and bonds, real estate, and some commodities. The other one just places their assets in the S&P 500. They had no way of knowing this at the time, but they happened to retire at the start of a wonderful decade for US stocks. Here’s how these hypothetical investors did after 10 years.

Scenario 1

The one who invested in the S&P 500, represented by the red line, had a huge decade, ending with a little over $3.5 million by the year 2000. At about 3 percent inflation, this person was taking a $60,000 income by that time, which amounts to about 1.7% of his portfolio. Our diversified individual, the green line, reached year 2000 with almost $1.3 million, and their $60,000 income withdrawal amounts to a 4.7% rate. Not as good as the S&P guy, but still pretty solid.

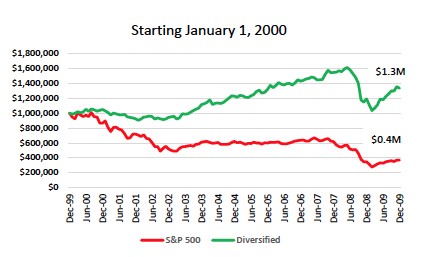

Scenario 2

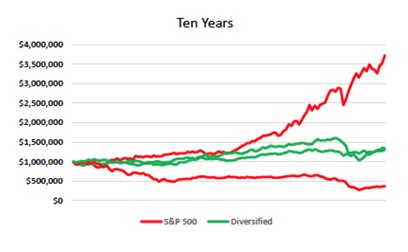

So to continue this hypothetical situation, let’s say their two younger friends heard about how well these two individuals did, and both of them decided to do exactly the same thing. These two retired on January 1, 2000, with $1 million, and started taking $45,000 per year of inflation-adjusted income. One of them diversified, the other went the S&P route – exactly like the previous two. But of course they had no way of knowing that they were retiring at the beginning of what turned out to be a really bad decade for US stocks. Here’s how THESE hypothetical investors did after 10 years:

The red-line S&P 500 investor, after a horrible ten years, had just $369,000 left from their original one million. At about 2.5% inflation, their $58,000 ending income withdrawal represented 15.6 percent of their total portfolio’s value. That’s not sustainable for very long. Our green-line diversified investor, though, ended up with a LOT more: over $1.3 million – almost exactly the same as their older diversified friend – and this person’s $58,000 income is just a 4.3 percent withdrawal rate from their portfolio.

So what does all of this tell us? It says that risk and volatility matter, especially early on in retirement.

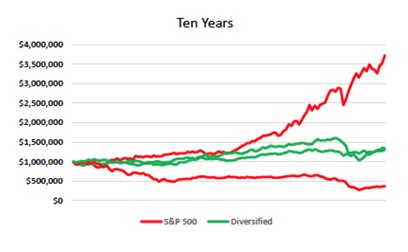

Summary

Let’s put all four of these 10-year periods in one graphic:

The red-line S&P investors in our example took more risk, and had a far greater range of potential outcomes. One potential outcome was great, the other one terrible. The green-line hypothetical investor took steps to potentially reduce their risk by diversifying, and had a much smaller range of potential outcomes.

The takeaway is that if you retire just as a good run for stocks is getting started, you may be in a better position than if you retire just prior to a bad run for stocks. The trouble is, it’s impossible to know or predict what the market will do in those early post-retirement years. That’s why managing risk matters.

And this is why we have a strategy. If we want to reach our goals, we aim to reduce the amount of risk we take along with our potential range of outcomes. And since we cannot predict the future with any accuracy at all, we believe that defending against the possibility of loss may give us better results in the end.

Want to learn more about Buckets? Are you concerned you may be taking too much unnecessary risk with your nest egg? We deal with this every single day at Lucia Capital Group. How can we help you the most? Just give us a call.

Important Information:

The information provided should not be considered specific tax, legal, or investment advice and is not specific to any individual’s personal circumstances.

Different types of investments and/or investment strategies involve varying levels of risk, and there can be no assurance that any specific investment or investment strategy will be profitable for a client's or prospective client's portfolio, thus, investments may result in a loss of principal. Accordingly, no client or prospective client should assume that the information presented serves as the receipt of, or a substitute for, personalized advice from LCG or from any other investment professional.

You should always seek counsel of the appropriate advisor prior to making any investment decision. All investments are subject to risk including the loss of principal. This material was gathered from sources believed to be reliable, however, its accuracy cannot be guaranteed.

Examples cited are hypothetical, are for illustrative purposes only, are not guaranteed and subject to potential federal and state law amendments. There is no guarantee that you will achieve the results discussed or illustrated.

Diversification strategies do not ensure a profit and cannot protect against losses in a declining market.

It is important to keep in mind that investments in fixed income products are subject to liquidity (or market) risk, interest rate risk (bonds ordinarily decline in price when interest rates rise and rise in price when interest rates fall), financial (or credit) risk, inflation (or purchasing power) risk and special tax liabilities. Interest may be subject to the alternative minimum tax.

S&P 500 Index is an unmanaged index and includes a representative sample of large-cap U.S. companies in leading industries. An investment may not be made directly in an index.

Rick Plum is a registered representative with, and securities and advisory services offered through LPL Financial, a registered investment advisor and member FINRA/SIPC. The investment professionals are affiliated with LPL Financial and are conducting business using the name Lucia Capital Group, a separate entity from LPL Financial.